louisiana inheritance tax return form

R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US. This right is called a usufruct and the person who inherits this right is called a usufructuary.

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

1 Total state death tax credit allowable Per US.

. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms. This form covers the death of the second spouse to die. The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Underpayment of Individual Income Tax Penalty Computation- Non-Resident and Part-Year Resident. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Over 50 Milllion Tax Returns Filed.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2. An inheritance tax return shall be prepared and filed by or on behalf of the heirs and legatees in every case where inheritance tax is due or where the gross value of the deceaseds estate amounts to the sum of fifteen thousand dollars or more. Louisiana inheritance tax return form.

However any income. 3062 the right to assert an inheritance rights is subject to a 30 year prescription. A final return was filed while the tax was still in effect but the IRS adjusts the federal return and additional Louisiana tax is due.

RS 2425 - Inheritance tax return. Succession is accepted unconditionally but see LA RS. Form R-1310 Download Fillable Pdf Or Fill Online Certificate Of Sales Tax Exemption Exclusion For Use By Qualified Vehicle Lessors Louisiana Templateroller Please check this page regularly as we will post the updated form.

Its also a community property estate meaning it considers all the assets of a married couple jointly owned. Ad Find Recommended Louisiana Tax Accountants Fast Free on Bark. The 5 million exemption will return for deaths occurring in 2026 and thereafter unless congress votes to extend the larger exemption.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Dont confuse estate tax with inheritance tax.

The louisiana estate transfer tax is designed to take. A partial return was filed while the tax was still in effect and a final return has not yet been filed. Find out when all state tax returns are due.

What to Bring When Visiting LDR. Yes Louisiana imposes an estate transfer tax RS. Underpayment of Individual Income Penalty Computation Resident Filers and Instructions.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. A Louisiana Inheritance Tax Return would also be needed in most cases and in some cases a federal Estate Tax Return will be required. No inheritance tax is owed and theres no need to file an Inheritance and Estate Tax Return with the Louisiana Department of Revenue.

Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Addresses for Mailing Returns. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Louisiana Inheritance and Gift Tax. Domesticated or income from louisiana. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due.

The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code. Repealed by Acts 2008 No. The Louisiana Department of Revenue would then issue a certificate that had to be attached to the petition for possession when the succession case was filed with the court.

Estate transfer taxAn estate transfer tax return must be prepared and filed for each. Louisiana does not have an inheritance tax. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or.

Requirements for Filing Returns Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher- itance tax is due or the value of the deceaseds estate is 15000 or more LSA-RS. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs. Social Security numbers of heirs are shown in the affidavit of valuation.

In fact as discussed below the Louisiana Department of Revenue has stopped issuing receipts It is unclear whether people who died on or before June 30 2004 will be subject to inheritance tax if an inheritance tax return was filed before July 1. Inheritance tax laws from other states could. Estate Transfer Taxes Who must file an estate transfer tax return.

Mississippi honor of louisiana tax return. An inheritance tax is a tax imposed on someone who inherits money from a deceased person. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

11012009 - present. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. There is no louisiana inheritance tax for people who die after june 30 2004.

Louisiana does not impose any state inheritance or estate taxes. Louisiana department of revenue inheritance gift and estate transfer taxes section p. Louisiana law used to require that an inheritance tax return be filed with the Louisiana Department of Revenue before a succession was opened.

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

12 Inheritance Tax Remaining Collections. 0 Fed 1499 State. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary.

However qualifying estates will still be subject to federal estate taxes.

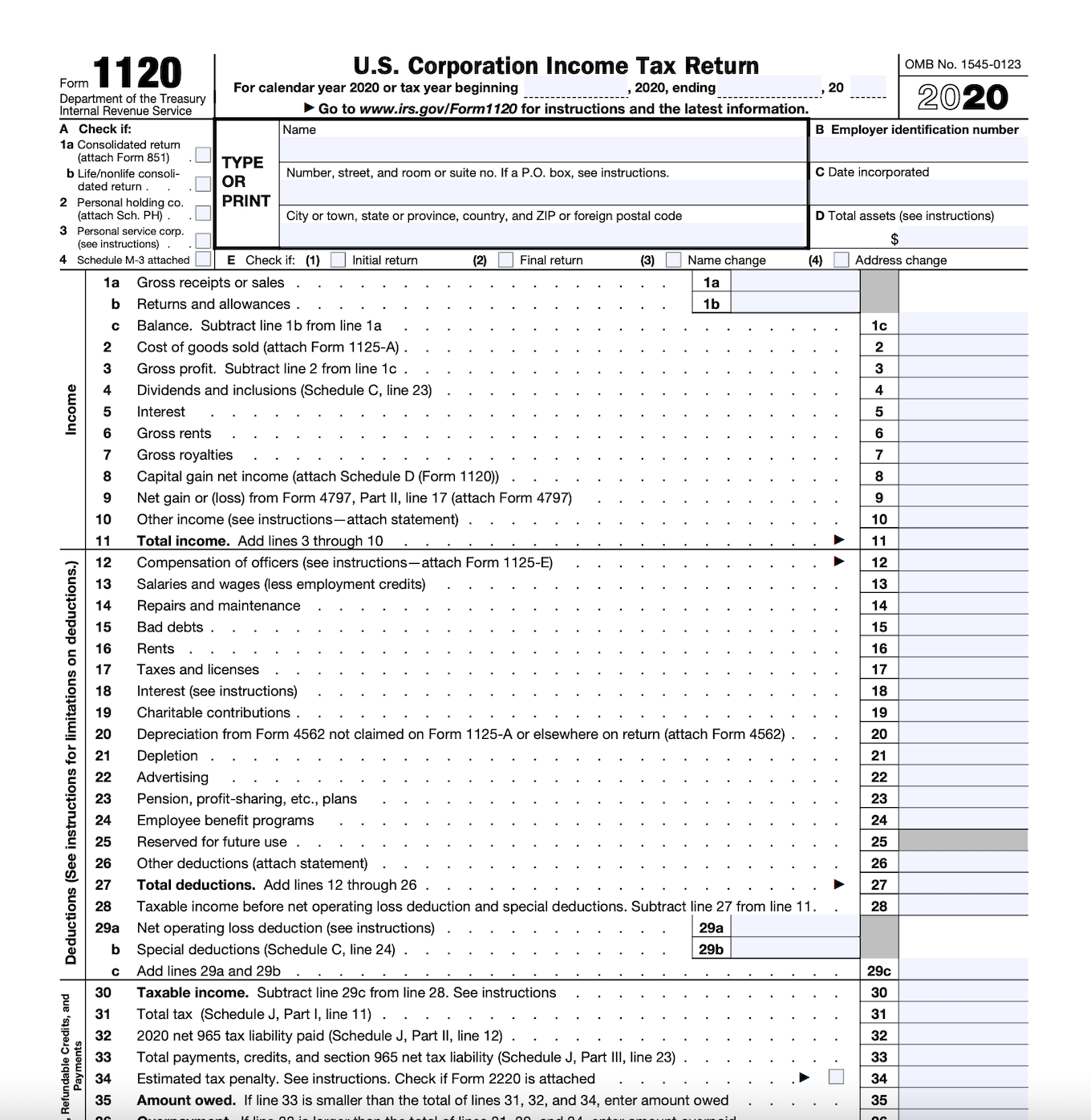

Form 1120 How To File The Forms Square

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

How To File Taxes For Free In 2022 Money

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

How To Organize Your Important End Of Life Documents Washington National End Of Life Last Will And Testament Washington National

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

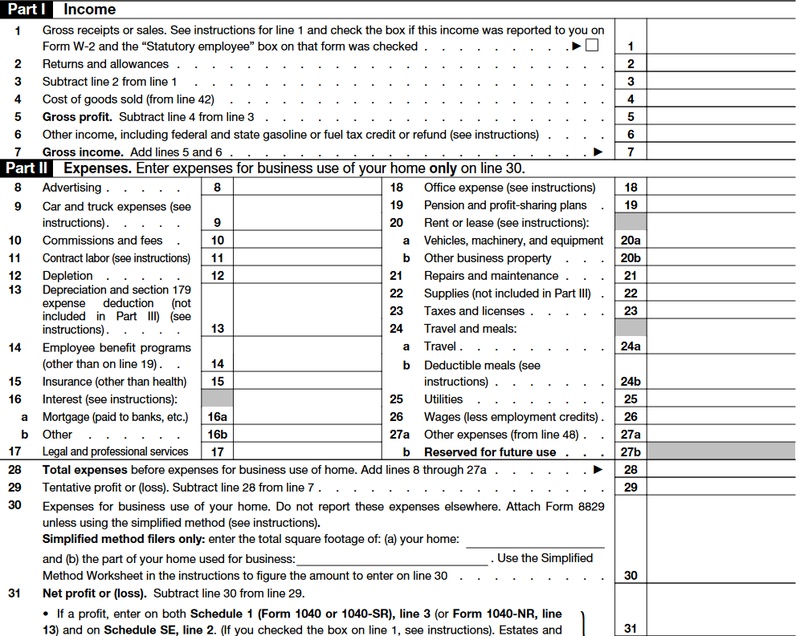

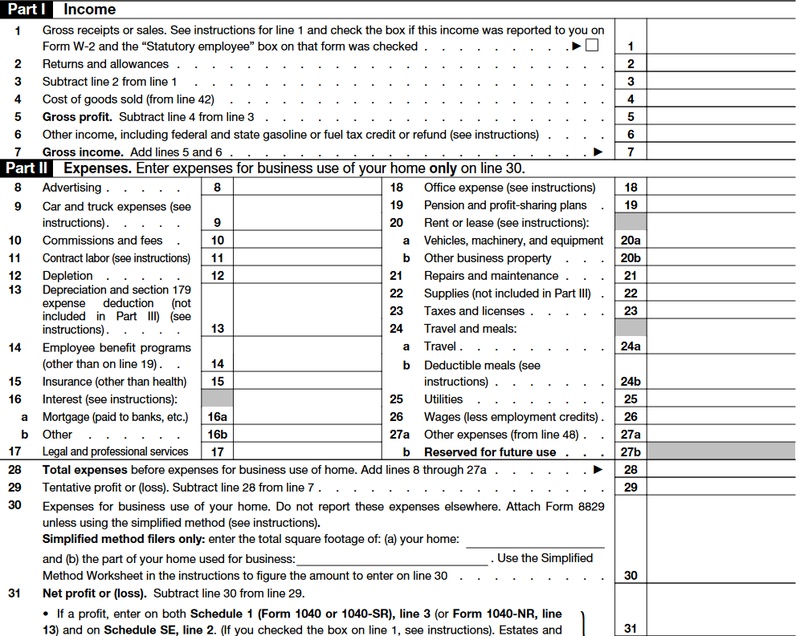

What Is Schedule C Tax Form Form 1040

What Is Schedule C Tax Form Form 1040

Lake Charles Real Estate Lawyers Law Firms Estate Lawyer Lake Charles Law Firm

Tax Form Templates 5 Free Examples Fill Customize Download

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Get Our Image Of Quit Claim For Final Pay Template For Free Quites Mississippi Templates

Tax Form Templates 5 Free Examples Fill Customize Download

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Sole Proprietor Tax Forms Everything You Ll Need In 2022 The Blueprint

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms

Bond For Deed Bond For Title 0001 Real Estate Forms Real Estate Contract Legal Forms

Free Louisiana Last Will And Testament Template Pdf Word Eforms Free Fillable Forms Last Will And Testament Will And Testament Louisiana