south dakota property tax exemption

Please submit your request to the Department of Revenue Special Tax Division 445 East Capitol Avenue Pierre SD 57501-3185. All property is to be assessed at full and true value.

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse.

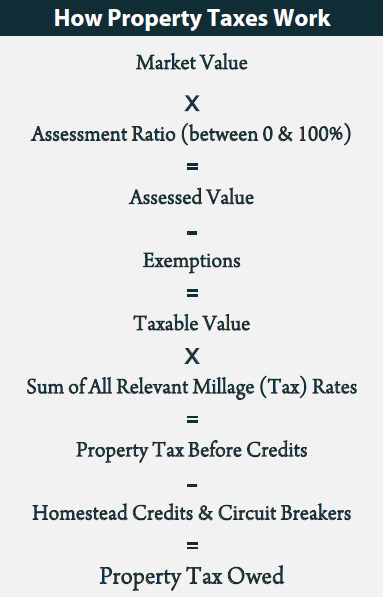

. One hundred fifty thousand dollars of the full and true value of the total amount of a dwelling or. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised. Not all states allow all exemptions listed on this form.

In Vermont disability exemptions can range from a low of 283964 to a high of 283964 based on percentage. Andys Restaurant provides an exemption. If you have questions check out our Disabled Veteran Property Tax Exemption Brochure or feel free to call our Property Tax Agents at 1-800-829-9188 Option 2.

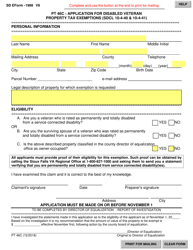

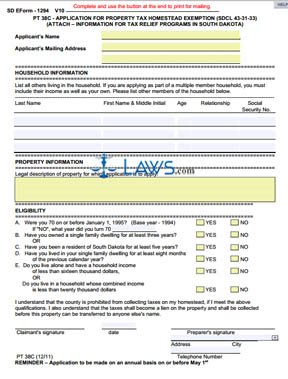

The states laws must be adhered to in the citys handling of taxation. Application for property tax exempt status sdcl 10-4-15 application must be filed with director of equalization by november 1 for consideration during county board of equalization the following. Applications for these reductions or exemptions can be obtained from and returned to this office or can also be obtained at the SD Department of Revenues links below.

Tax amount varies by county. Applications for these reductions or exemptions can be obtained from and returned to this office or can also be obtained at the SD Department of Revenues links below. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive.

All sales of tangible personal property and services are subject to the state sales tax plus applicable municipal tax unless exempt from. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Exempts up to 150000 of the assessed value for qualifying property.

Applications are accepted from May 1 to July 1. The governments from states without a sales tax are exempt from South Dakota sales. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Wind solar biomass hydrogen hydroelectric. Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes. Reduce property taxes for yourself or others as a legitimate home business.

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. Taxation of properties must. Partial exemption of dwellings owned by certain disabled veterans.

South Dakota property tax credit. In West Virginia veterans may be exempt from property taxes on the first. This is a multi-state form.

Property tax exemptions allow businesses and homeowners to exclude the added value of a system from. 128 of home value. Ad Fill Sign Email EForm-1932 More Fillable Forms Register and Subscribe Now.

Then the property is equalized to 85 for property tax purposes. The property subject to this exemption is the same property eligible for the owner-occupied classification To be. South Dakota offers property tax exemptions for installed solar systems.

South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. South Dakota Property Tax Exemption for Disabled Veterans. If the county is at 100 of full and true value then the equalization.

The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax. Not exempt Minnesota motels and hotels are not exempt North Dakota Ohio and West Virginia.

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

Income Tax Update Special Session 2021

State Tax Treatment Of Homestead And Non Homestead Residential Property

Property Tax Comparison By State For Cross State Businesses

Property Tax South Dakota Department Of Revenue

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

South Dakota Estate Tax Everything You Need To Know Smartasset

South Dakota State Veteran Benefits Military Com

Sd Form 1988 Pt46c Download Fillable Pdf Or Fill Online Application For Disabled Veteran Property Tax Exemptions South Dakota Templateroller

Property Tax Homestead Exemptions Itep

At What Age Do You Stop Paying Property Taxes In South Dakota Clj

South Dakota No Tax On Food Avalara

South Dakota Real Estate Transfer Taxes An In Depth Guide

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

Sales Taxes In The United States Wikipedia

State Lodging Tax Requirements

Real Property Tax Exemption Information And Forms Town Of Perinton